January 2014 Many traders think in terms of buying (selling) interest rate futures to capitalize on anticipated falling (rising) yields in response to changes in Fed policy or to dynamic macroeconomic conditions. Some take a more subtle approach by trading spreads between, for example, CBOT

Inside Advantage Winter 2018

The Advantage Futures quarterly magazine provides informative articles on top industry news and developments, as well as Advantage Futures updates, seminar recaps, and upcoming events. View the latest issues by clicking the related links below, and receive your own copy by signing up for Advantage News.

Interest Rates: Trading the Swap Spread

By John W. Labuszewski, Managing Director Research & Product Development, CME Group

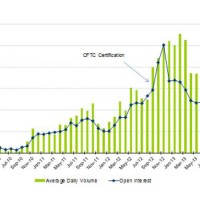

Ten Years of Risk

By Bill Steele, Chief Risk Officer, Advantage Futures

November 2013 The last decade has been marked by transition for Advantage Futures and the futures industry: the progression from pit to screen, the shift to 24-hour markets, the move by the individual trader into trading groups, the increase in international clientele and the consolidation

Ten Years of Technology

By Tom Guinan, Chief Technology Officer, Advantage Futures and Ambaj Sharma, Senior…

November 2013 Wow, what a decade it has been! Futures trading volume was transitioning from open outcry to electronic screens when Advantage Futures opened for business in June 2003. Technology and connectivity options were evolving from T1s exchanges used to transport market data and order

Why Professional Traders Should Consider European Volatility

By Megan Morgan, Vice President, Business Development, Eurex Exchange

November 2013 An active Twitter personality with clear views on electronic markets, Megan Morgan,Vice President of sell side business development at Eurex Exchange, is an advocate of VSTOXX® as the volatility benchmark for the European time zone. In this interview, she explains why professional volatility