August 2016

Which Path is Right for You?

Independent Software Vendors (ISVs) carved out a niche to meet the demands of today’s sophisticated traders. Advantage Futures is vendor-neutral, allowing clients the flexibility to select the best fit for their trading needs. Clients determine the appropriate software for their trading operation by considering multiple factors including trading strategies, latency, exchanges and products, charting, options and options market making, algorithmic/automated trading, custom configuration and cost.

ISVs incorporate a variety of products and enhancements to broaden their reach and appeal. Advantage Futures helps traders determine the best software for their unique requirements based on experiences with current clientele and relationships with vendors. Representatives often assist in the selection process and make the appropriate introductions.

Advantage works closely with our ISVs to better understand their products, value propositions, innovations and differentiation in the marketplace. Highlighted is the evolution of these vendors and their current product offerings in the market.

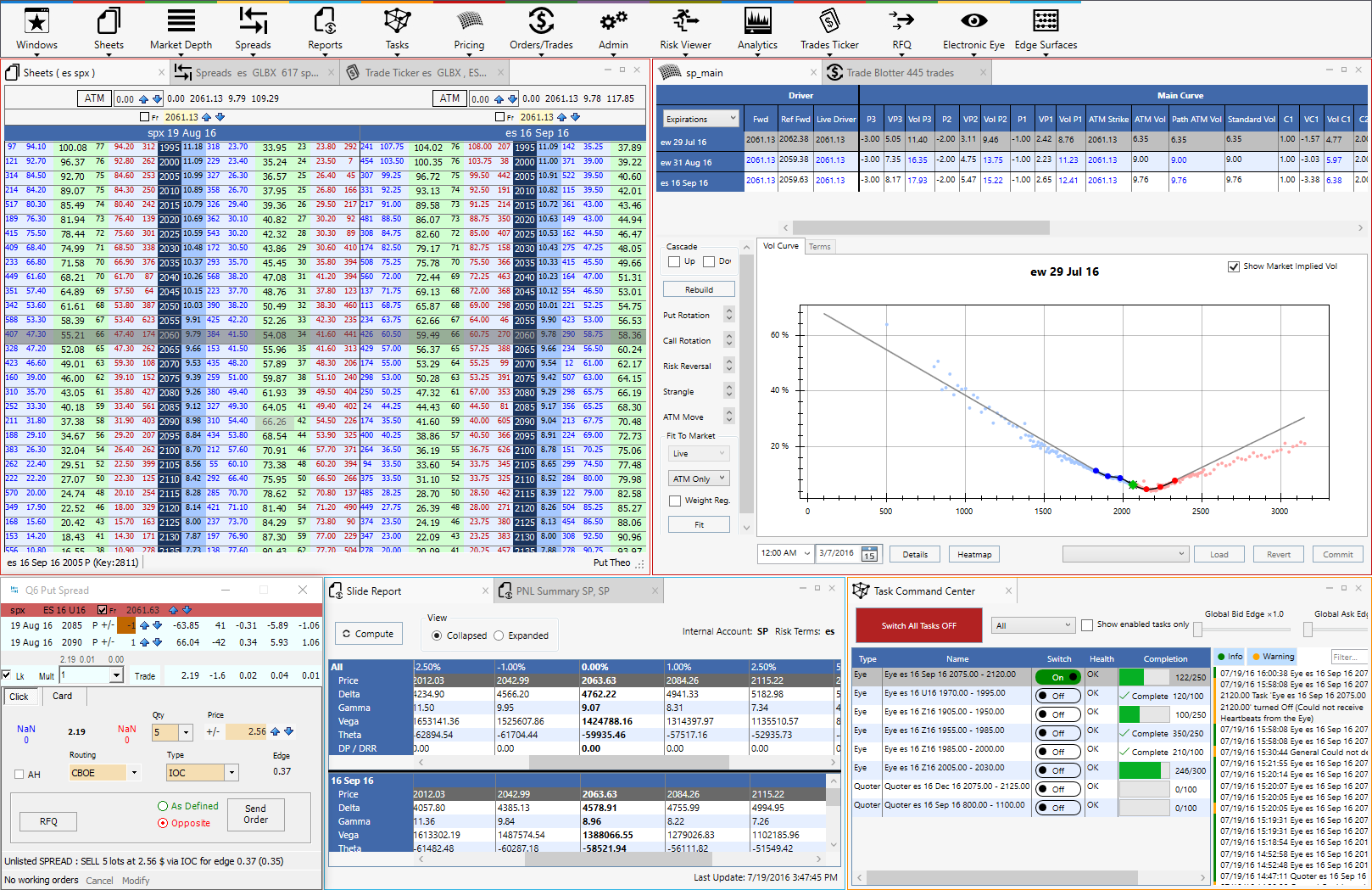

BTS Blue Trading Systems

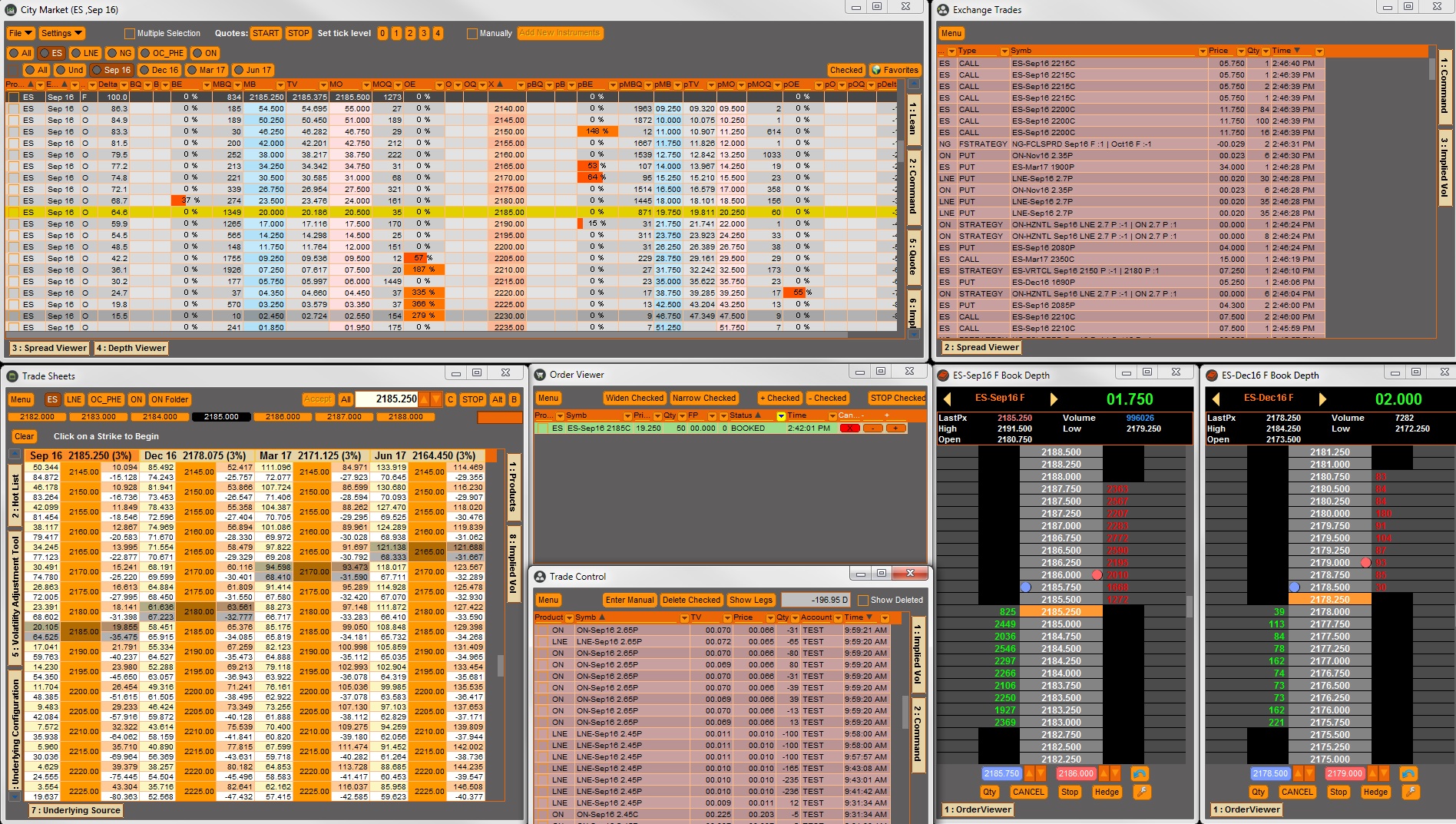

Blue Trading Systems is a young company formed by principals who have worked together since 2001. BTS spun out of the highly regarded market making firm Blue Capital Group in 2011 after negotiating ownership of the system and intellectual property they started building in 1998. The experience and tools acquired over years working closely with some of the most successful, demanding traders in the business offered the perfect foundation on which to build a commercial trading system.

Today, BTS delivers comprehensive, high-performance trading solutions to professional options and futures traders. Clients benefit from the considerable time and effort invested in producing this advanced trading system, which successfully weathered many market cycles often in extreme conditions. BTS’s user interface, tested over years in the market, offers an intuitive process to both assist with trading decisions and scour for opportunities. The flexibility to set volatility curves to reflect true market value leads to reliable prices and realistic, accurate risk reports. Together, these tools provide a solid technological foundation for market makers, proprietary trading groups and brokers alike.

While much of the product offering has roots in proprietary on-floor market making, BTS rebuilt its electronic trading system from the ground up to achieve the latency profiles necessary to compete in today’s highly competitive electronic derivatives market. The company is dedicated to remaining at the forefront of options and futures technology, focused on building for the trader of tomorrow. BTS works continuously to optimize and expand its low latency electronic trading offering. Fast release cycles ensure the software responds quickly to changing industry conditions.

BTS’s support team is made up of industry veterans who understand the urgent nature of this business, as well as the notion that technology issues can be expensive and time consuming. Critical production issues receive immediate attention from the support, engineering and management.

Tenure as a trading firm is part of BTS’s DNA. The company builds practical, efficient solutions to complex problems presented by today’s capital markets. The team takes pride in its work, holds itself to a high standard of quality and resolves issues quickly–all in vigorous support of its product and clients.

919.913.0850

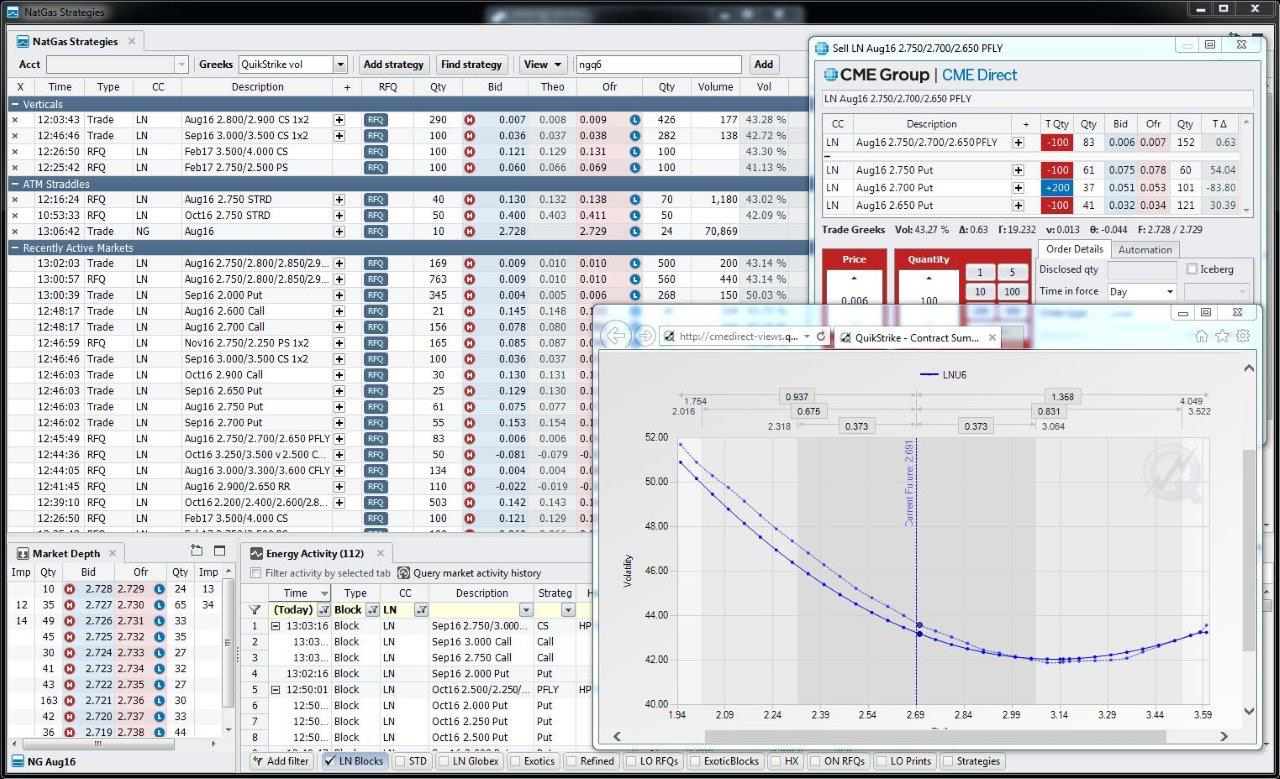

CME Direct

CME Direct is a free, highly-configurable trading front-end that provides access to CME Group futures, options and OTC markets on a single, easy-to-use platform. CME Group launched CME Direct in May, 2012 as a front-end to OTC energy markets. Since launch, they added support for multi-asset class trading, including complete CME Globex coverage, options strategies, RFQs and booking of block trades. Most recently, CME Direct integrated with premier options analytics provider QuikStrike to offer users access to cutting edge options and volatility tools. Users can access QuikStrike analytics directly from the CME Direct platform. CME Direct clients can also take advantage of CME Pivot, an advanced instant messaging (IM) platform that integrates seamlessly with the front-end and provides clients intelligent message parsing and extensive collaboration technology.

CME Direct is designed to meet a range of trading needs and provide support across the trade life cycle:

- Pre-Trade: CME Pivot offers intelligent parsing and IM technology that separates markets from conversations, converts text to data and helps traders capture and use critical market information. Traders can engage QuikStrike’s analytics tools for pre-trade scenario analysis and idea generation.

- Trade: Traders can access futures, options and OTC markets side-by-side, display real-time Block Trade data, send RFQs and execute covered and multi-leg option strategies on CME Globex.

- Post-Trade: Straight-Through-Processing enables real-time trade flow between the front and middle office. Traders benefit from these automation tools that eliminate dual-keying and potential re-entry errors.

Traders and brokers find CME Direct particularly well suited to meet their futures and futures options trading needs. Traders choose the best way to execute trades using CME Direct either online or through their voice broker. Brokers can view CME Group products on one screen to execute on a client’s behalf, or they can use CME Direct to quickly process voice-negotiated blocks.

New versions of CME Direct are regularly released and automatically updated to ensure clients utilize the most current version with the latest features. CME Direct continues to add new functionality with a mobile version expected in the near future.

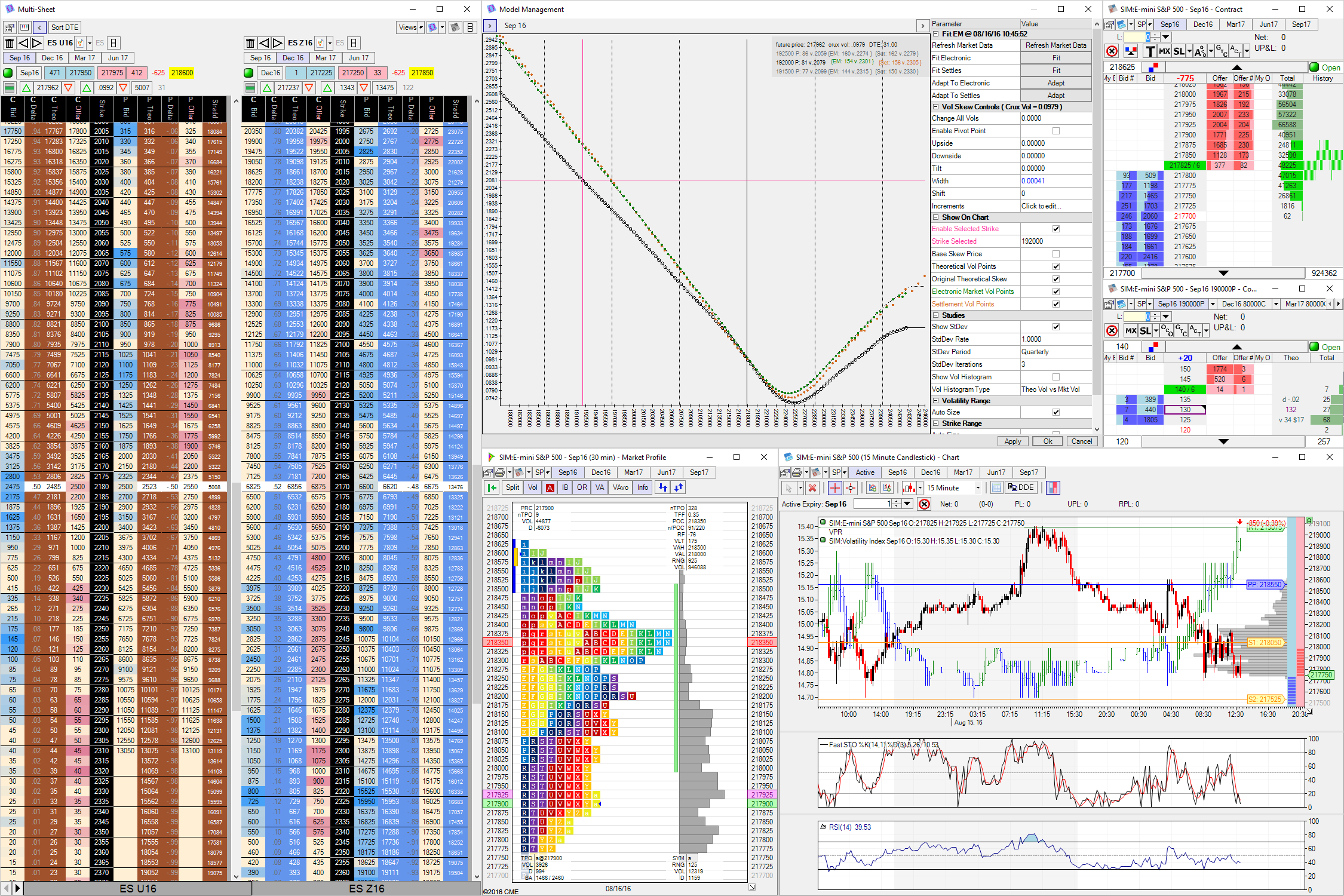

CQG

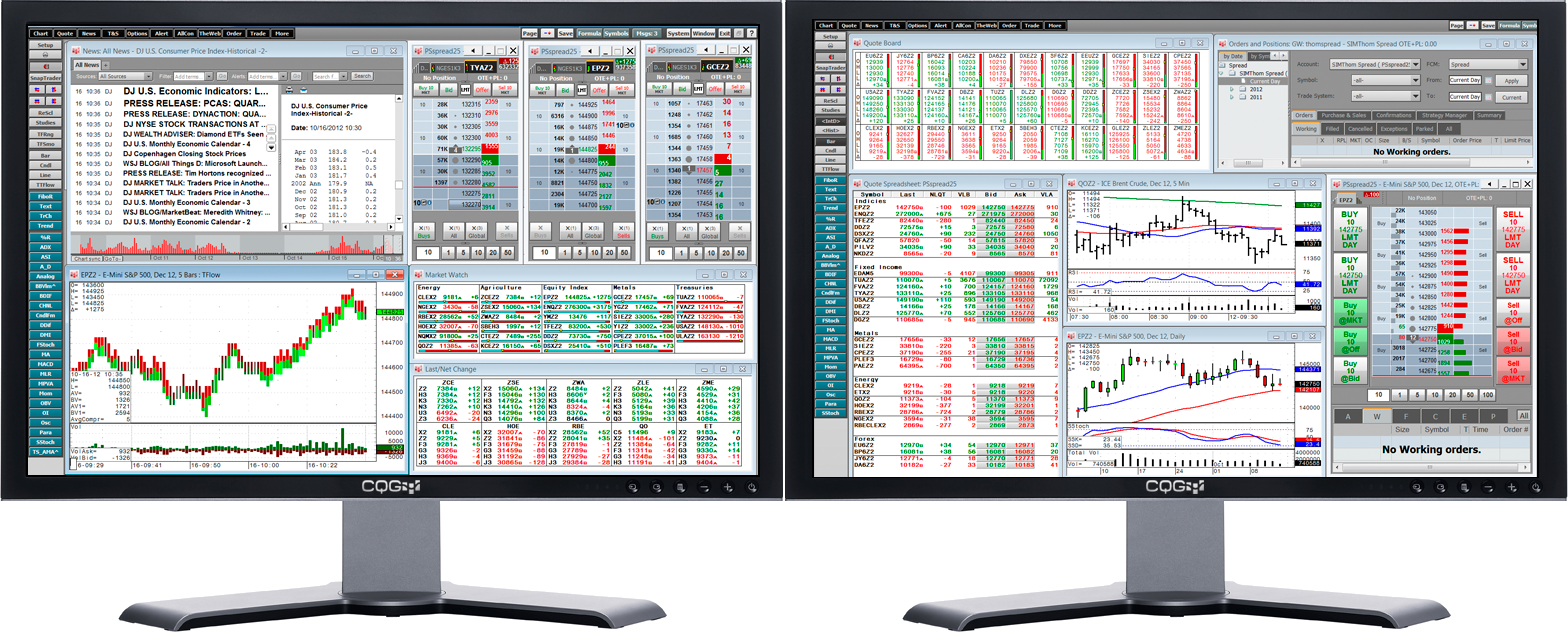

CQG was founded in 1980, well before the emergence of electronic trading, as a charting and quotes platform. The company, headquartered in Denver, Colorado, continued its leadership in charting and analytics by building an entire ecosystem around its flagship product CQG Integrated Client. CQG employs over 350 people worldwide and boast approximately 7,000 users of CQG Integrated Client. The advanced charting and analytics functionality of CQG make it ideal for technical traders. In addition to 24-Hour call and email support, CQG offers free training with product specialists, an extensive YouTube library of support videos and an innovative collection of add-ons available through the CQG Workspaces website.

CQG was founded in 1980, well before the emergence of electronic trading, as a charting and quotes platform. The company, headquartered in Denver, Colorado, continued its leadership in charting and analytics by building an entire ecosystem around its flagship product CQG Integrated Client. CQG employs over 350 people worldwide and boast approximately 7,000 users of CQG Integrated Client. The advanced charting and analytics functionality of CQG make it ideal for technical traders. In addition to 24-Hour call and email support, CQG offers free training with product specialists, an extensive YouTube library of support videos and an innovative collection of add-ons available through the CQG Workspaces website.

CQG expanded its product offering beyond charting and analytics:

- CQG Integrated Client caters to professional traders.

- CQG Spreader adds spreading functionality.

- CQG Trader is the base offering targeting retail clients who may not require advanced technical analysis tools.

- CQG AutoTrader is a proprietary trading execution engine that allows clients to execute numerous systems simultaneously with equal precision and discipline. Integration with various position monitoring modules and CQG Spreader, enable clients to monitor trading signals and positions on charts and trading interfaces.

- CQG provides a formula builder and full integration with Microsoft Excel, including the ability to trade directly through Excel.

- CQG offers mobile access with CQG M for iOS devices and Android phones and tablets.

- CQG Continuum provides a data and trading Enterprise API with global exchange connectivity.

Advantage witnessed tremendous growth in the popularity of CQG. CQG’s model of providing electronic trading tools, global market data and access and advanced analytics in one application makes a compelling case. CQG serves professional traders who are more visually oriented or looking for a high level of support with the simplicity of one application.

800.525.7082

CTS Cunningham Trading Systems

Cunningham Trading Systems (CTS) was founded in 2004 and named after founding partner Bill Cunningham. CTS users range from retail traders to professional traders including institutions, CTAs and Introducing Brokers. Most traders using CTS primarily trade products on CME Group and ICE. CTS also offers connectivity to EUREX, LIFFE, Euronext, CFE and LME.

CTS’s flagship product, T4, includes Desktop, Mobile and Charts, with additional features available to complement the core functionality. TradeSniper is a new client-side feature that allows trading and charting of numerous custom spread combinations. T4 Charts have a variety of studies and indicators as well as the ability to trade directly from a chart and export data into Excel. The CTS Options Pro package grew significantly over the last two years. In addition to the existing model management, theoretical sheets and strategy solver, Options Pro now contains a FaST board, multi-account analyzer, estimated portfolio margin and shock matrix.

CTS offers both a .Net and a FIX API for traders looking to implement custom trading strategies or just a widget to assist with trading. Both APIs provide access to all exchanges.

CTS recently released the T4 Mobile app for Android. This app has live quotes, trading ability, charts and chart trading, as well as account information such as fills, working orders and P&L. An iPhone app will be available Q4 2016.

T4 allows each trader to customize the workspace for an easy transition from a multi-monitor desktop to a tablet or laptop. CTS offers a free trial in their simulation environment with live data and full functionality. The CTS software can be downloaded to a desktop PC, an Android device or accessed through a web browser.

With thousands of active traders, CTS is a formidable competitor. 24-Hour support, reliability and a transactional pricing structure with a cap make CTS the third most popular front-end at Advantage.

312.939.0164

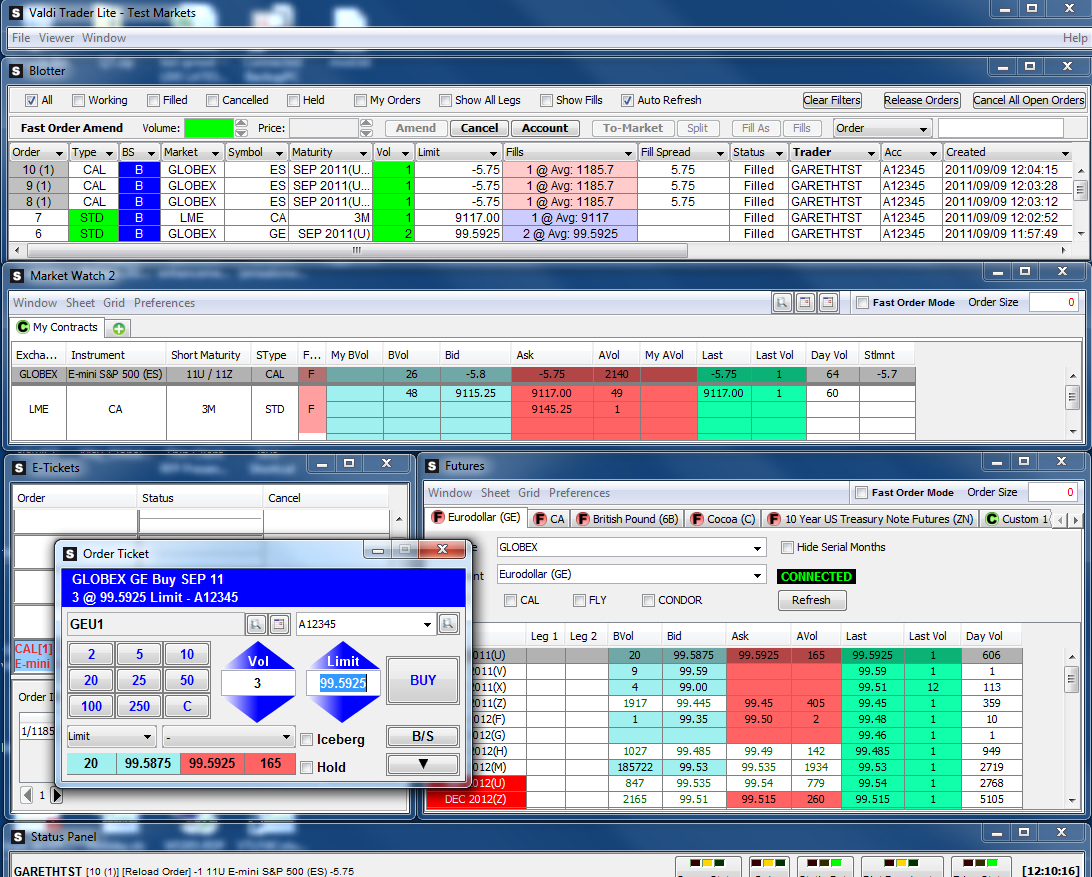

FIS’ Valdi

FIS’ Valdi, formerly SunGard through the acquisition of GL TRADE, is the integration of SunGard’s Global Trading business. The Valdi brand includes the company’s market data, trading and post-trade solutions and listed trading solutions GL and Brass. FIS’ Valdi has been at the forefront of global exchange-traded derivatives for over 25 years, offering access to 75+ derivatives exchanges and major clearing venues worldwide. Valdi is a suite of global multi-asset trading solutions for listed equities, derivatives, commodities and fixed income instruments. Valdi provides market data; advanced trade, order, execution and liquidity management systems; as well as pre-trade and post-trade risk and compliance solutions.

FIS’ offers a broad range of trading workstations based on both Microsoft Windows and thin-client technologies. While the Valdi suite spans a broad range of software solutions, Valdi Futures Trader and Valdi Trader are the flagship products for derivatives screen trading.

Valdi Futures Trader, the core Windows product, is a professional workstation specialized for Derivatives traders, providing simple and efficient ergonomics for selection, monitoring and trading of single-leg, complex and custom instruments. It offers a feature-rich trading experience in a package intended for ease of deployment with no configuration or setup required on the trader’s PC. The workstation is optimized to operate over private networks and the internet. Valdi Futures Trader is widely installed throughout the world and supports a broad range of trading styles across all major asset classes.

Valdi Trader offers a variety of trading styles across major asset classes and trading venues, including spreading functionality with user-defined spreads. Valdi Trader adds specialist capabilities for multi-legged strategies and algorithmic and Excel-based trading. The workstations support sales and dealer functionalities for use with order management, position tracking and market-making applications.

OptionsCity

Founders of OptionsCity began with two objectives: Create an enjoyable workplace and build great software. OptionsCity, since inception, pushes the limits of their software trading technology.

OptionsCity upgraded both the functionality and performance of Metro, their flagship market making platform. Additionally, they expanded their product portfolio this past year with new offerings for professional and retail traders.

Metro offers options pricing and analytics with the ability to set skews, analyze Greeks and execute trades both manually and algorithmically. The latest version provides enhanced functionality for energy traders and improved performance for those looking to stream quotes and make markets. The platform offers hosted servers in colocation facilities near supported exchange matching engines. Additionally, OptionsCity’s City Store and the Freeway API allow for custom application development for additional analytics and trading functionality. Metro is available with various pricing bundles.

New this year, OptionsCity CityTrader enables web-based execution of futures and options on futures products. The platform is available through any internet browser and offers some of the advanced options functionality of Metro including spread trading and the ability to submit RFQs. The accompanying REST-based City API allows traders to develop custom trading solutions using the same real-time market data and position management tools available in CityTrader. At a price point of $50/month plus execution fees, the platform delivers excellent performance for less latency sensitive traders who still require advanced functionality.

The latest product offering from OptionsCity is City Execution, a futures and options execution application built directly into the Thomson Reuters news and analytics platform, Eikon. Eikon clients can realize significant savings by eliminating a third party platform and accompanying market data fees. City Execution integrates seamlessly into Eikon so the user experience feels native to the application.

OptionsCity’s entrepreneurial spirit and commitment to innovation have established the firm as a contender in the options trading space. With their new set of products, OptionsCity makes a compelling case for futures traders.

ProOpticus

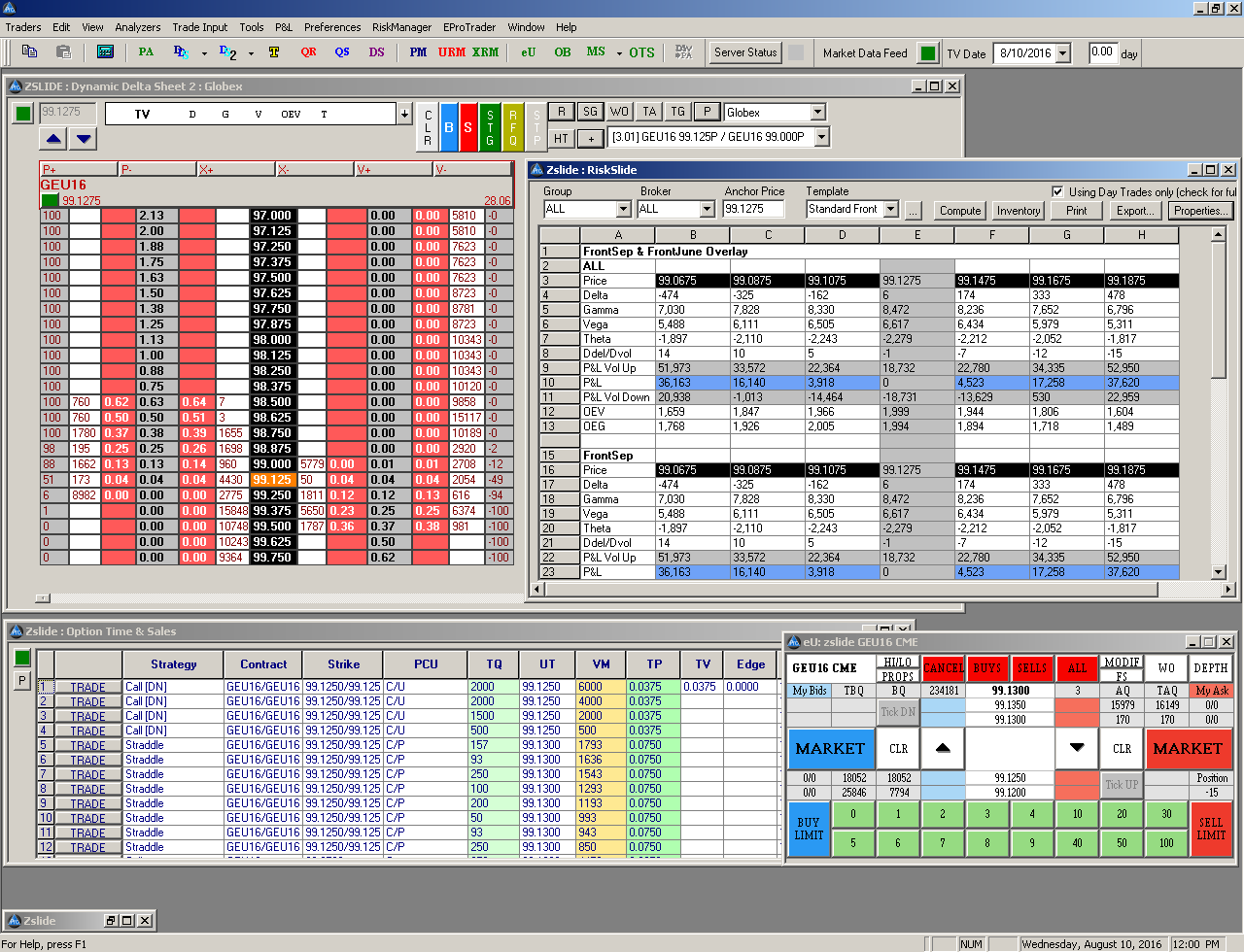

Prime Analytics LLC, makers of ProOpticus, formed in 1994 when John P. Kelley, Executive Managing Director of Prime Analytics LLC, identified a need for a sophisticated options analytics tool while assisting his clients in evaluating strategies across the yield curve. As a member of the Chicago Board of Trade and a floor broker in the U.S. Treasury Options Complex, Kelley understood what traders wanted and needed from professional derivatives software. Existing options software lacked the capability to provide risk measurement and management in a meaningful way for complex option portfolios. In particular, the functionality for performing stress tests and “what if” analysis across correlated product groups—essential tools needed for making informed trading decisions—did not exist. Prime Analytics resolved to provide innovative and timely solutions for clients.

The ProOpticus Market Making and Universal Risk Manager (URM) platforms are supported and enhanced by trading and risk industry professionals, including former proprietary traders, hedge fund traders and risk managers. The URM is an enterprise risk solution for all asset classes for FCM’s, banks and hedge funds. ProOpticus is currently deployed by some of the world’s largest FCM’s.

ProOpticus will release its second generation electronic trading platform “Reason 2” in the fourth quarter of 2016. Reason 2 will integrate automated trading features accompanied by the valuation and risk components that trading and risk professionals have relied on for over twenty years.

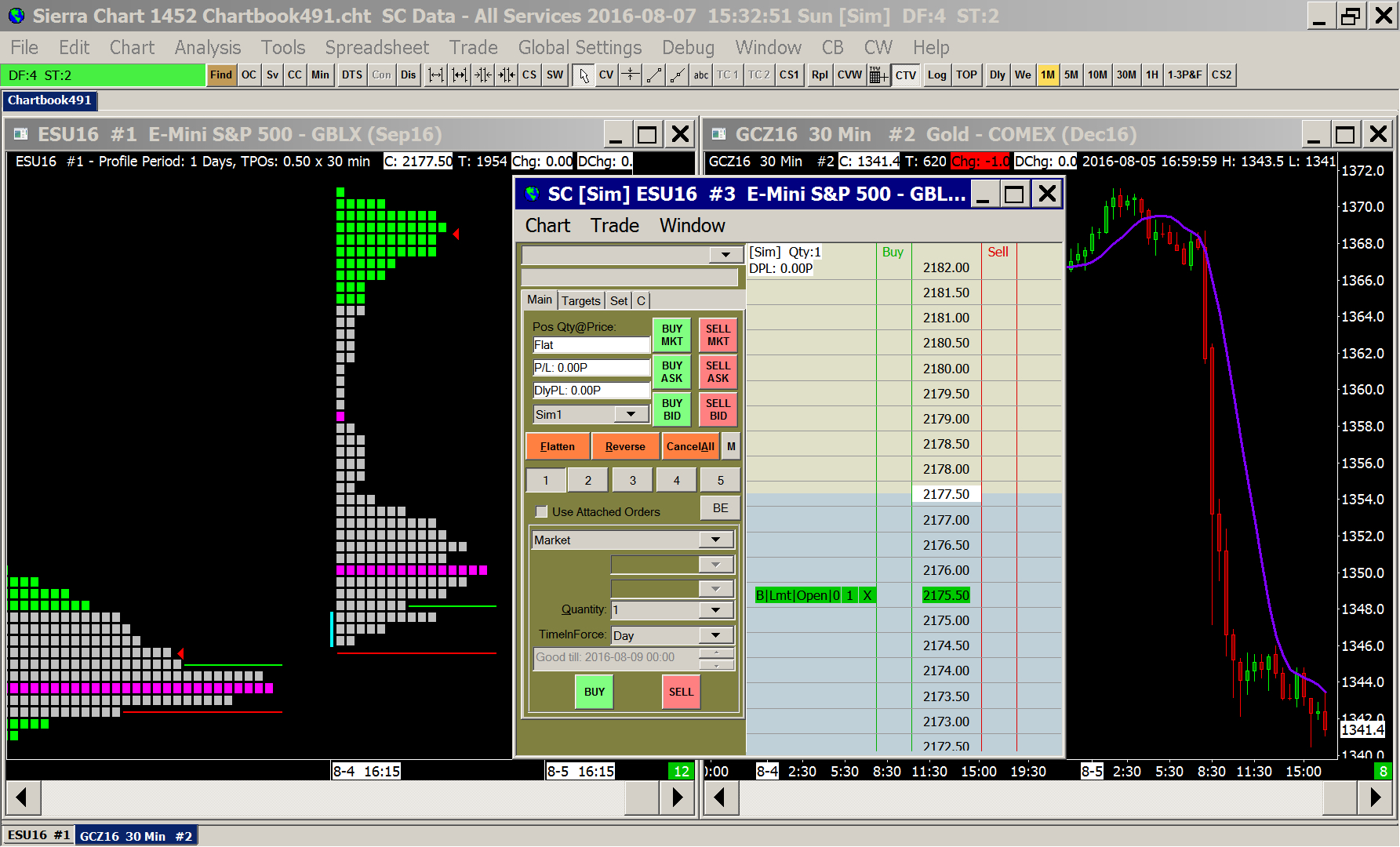

Sierra Chart

Sierra Chart develops professional-quality charting and trading software for futures, Forex and equities traders and offers direct market data feed from multiple international exchanges. Proven and trusted by investors, traders and clearing firms since 1994, Sierra Chart is a long-established and stable program with vast functionality and a global operation with users worldwide.

Sierra Chart is best known for its balanced and open design. It is highly customizable and easy to integrate with trader strategies and style of trading interfaces while supporting automated trading. All aspects of charting and trading can be customized, including creating and applying custom studies and indicators. Sierra Chart offers a broad array of drawing tools and built-in studies while allowing users to create tailored studies using the Spreadsheet Study feature and the C++ based interface.

Sierra Chart supports direct connections to numerous Data and Trading services. It does not use any in-process blackbox API components, Java or .NET. Sierra Chart supports DTC, making it automatically compatible with any external Data or Trading service supporting the DTC Protocol.

Sierra Chart is currently working on enhanced integration with CTS (Cunningham Trading Systems) for a lower per-trade cost. They are expanding the API to provide greater programmatic access to the built-in functionality.

The platform is an effort of engineers around the world developing and supporting the software and services. Technical support promptly corrects software or service issues that may arise–often in a matter of hours.

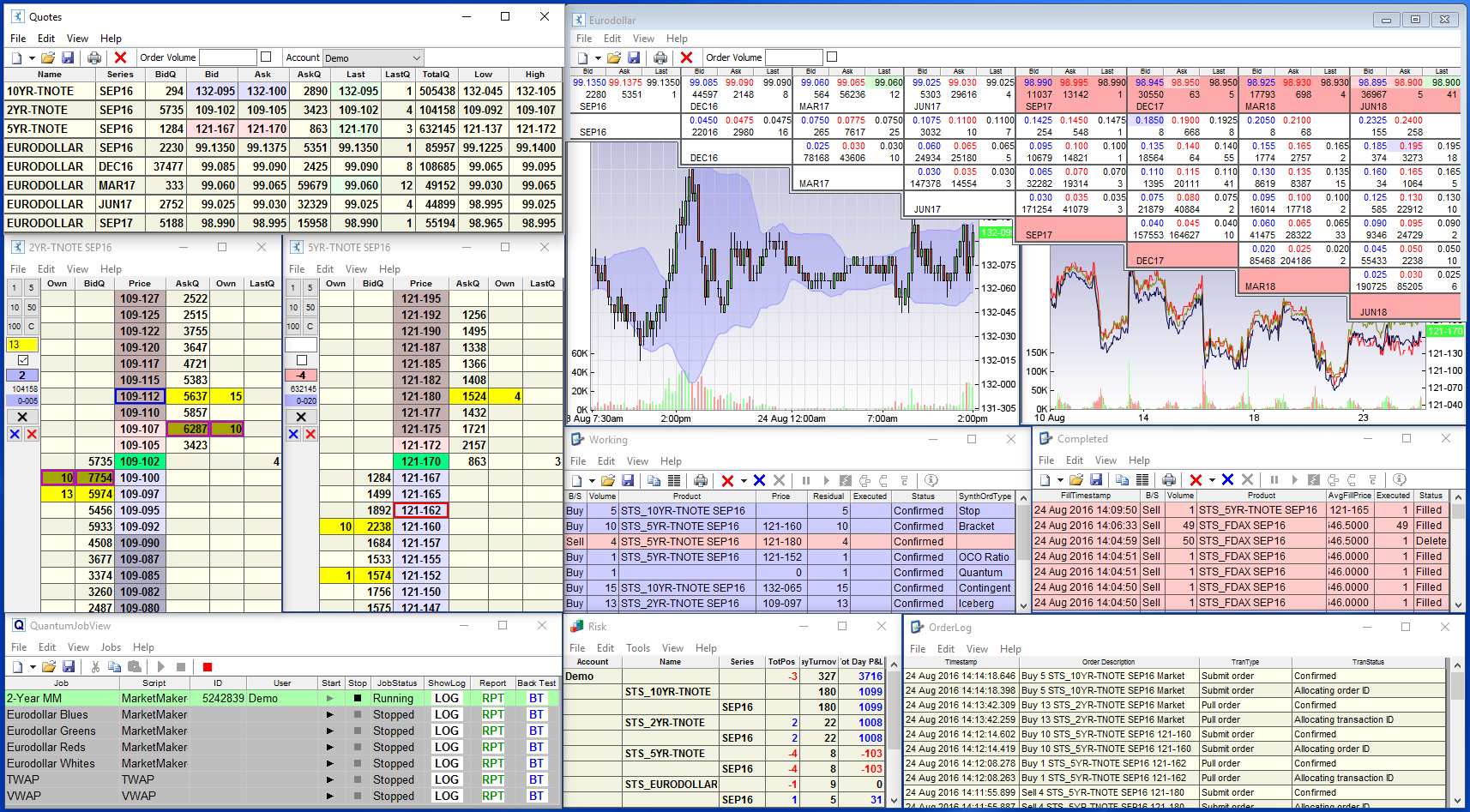

Stellar Trading Systems

Established in 2003, Stellar Trading Systems, delivers performance, functionality and innovation on a complete, enterprise-class trading system. Stellar is headquartered in London with additional offices in Chicago and Singapore. Clients access Stellar on their servers or directly from Stellar’s fully hosted ASP platform. The ASP solution offers connectivity to an extensive number of markets and colocation facilities.

Stellar appeals to professional traders, from point and click to sophisticated algorithmic, latency-sensitive traders using a broad range of products and asset classes.

Spread traders benefit from spreadMachine, Stellar’s flagship product that delivers incredible speed by harnessing the power of its server hardware and building on the high-performance order routing engine within the Stellar architecture.

Stellar’s Quantum Server is an ideal platform to build a wide variety of algorithmic or automated strategies. Stellar also offers a comprehensive, low latency, open system API with FIX connectivity. Other functionality includes a wide variety of synthetic order types, Stellar Aggregator, Stellar Charts and back testing. The flexible Stellar front-end makes it easy for new users to create a familiar look and feel, enabling effortless migration onto the Stellar platform.

Stellar is continually refined and enhanced to ensure it remains at the cutting edge of trading technology.

Support@StellarTradingSystems.com

Trading Technologies

Trading Technologies, a driving force behind the shift from floor to electronic trading, pushed the limits of financial technology over the last two decades and set the standard for today’s professional trading platforms.

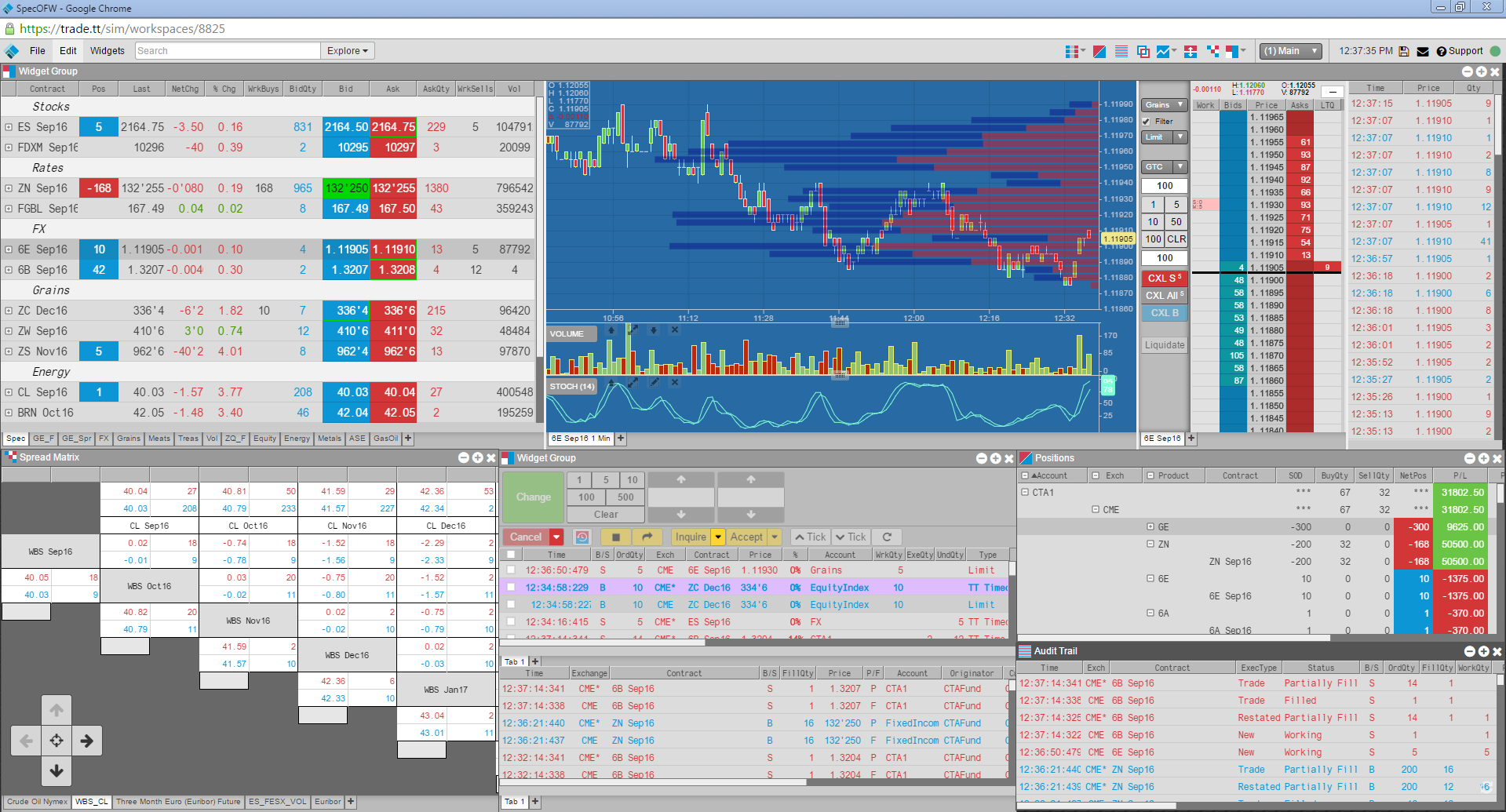

Trading Technologies’ original trading platform, X_TRADER®, was introduced in 1994. In March 2015, the company launched TT®, the first futures trading platform to utilize a cloud-based software-as-a-service (SaaS) architecture.

TT leverages hybrid-cloud platform architecture to combine incredible performance and accessibility with the most popular features from the legacy X_TRADER platform, including its industry-standard MD Trader® ladder, Autospreader® and ADL® (Algo Design Lab). TT utilizes colocated execution facilities for exchange connectivity and real-time market information, along with the AWS private cloud for storage of user configurations, workspaces, “forever audit trail” data and other non-latency-sensitive components.

TT users can access professional-grade tools such as Autospreader and charting on their mobile devices to monitor and trade from anywhere. Users benefit from the latest version of TT each time they log in because the platform auto-updates as enhancements are made. TT’s intuitive interface and simplified settings allow traders to create personalized workspaces, custom widgets and fully configurable tools from a desktop, laptop or mobile device.

TT set new performance records as the fastest commercially available futures trading platform and continues to develop new functionality, such as options trading, enhanced charting and analytics and a globally distributed Autospreader.

312.476.1000