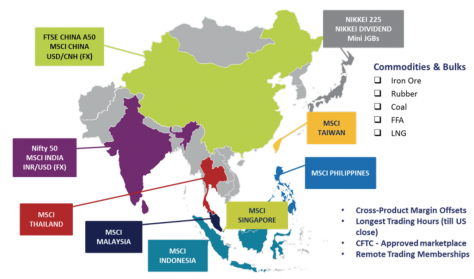

Headquartered in AAA-rated Singapore, SGX is globally recognized as a leading liquid pan-Asian multi-asset exchange in Asia. Since pioneering the Nikkei 225 futures contract in 1986, SGX is amongst the leading offshore markets for global participants to access and trade key Asian economies (China, Japan, India and Southeast Asia) on a single platform. Leveraging on a strong equity derivatives franchise, SGX also lists FX and commodity products linked to the Asian region.

SGX performance 2017

SGX achieved a solid performance in 2017 across its equity index franchise. The only offshore China A-share futures contract (SGX FTSE China A50 Index futures) continued to attract investors with an open interest increase of 18% YoY, ending the year above US $9 billion. Other contracts including SGX MSCI Taiwan Index futures and SGX MSCI Singapore Index futures also ended the year up 6% and 30%, respectively. In total, SGX’s ADV across equity derivatives and FX derivatives was 655,619 contracts, while open interest grew to 3,445,527 contracts by end of December 2017.

During the year SGX saw a focus on emerging markets, with MSCI Emerging Market Index (MSCI EM) and MSCI Emerging Markets Asia Index (MSCI EMA) continuing to outperform the MSCI World Index. With China, India and Taiwan comprising a significant weightage of over 50% to MSCI EM, there is an increasing need by capital allocators to manage risk exposure to these regions–adding to the liquidity on SGX. In response to this market need, SGX introduced futures on MSCI EM and MSCI EMA in November 2017 so participants can trade the regional indices alongside the Asian single-countries in the same time zone for capital and trading efficiency.

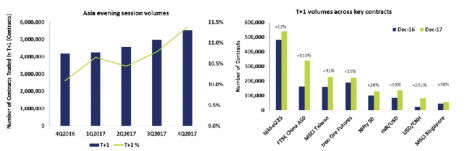

Growing liquidity in the global trading hours

With Asia’s growing influence on MSCI EM, in particular the anticipated inclusion of China A-shares into the MSCI basket in 2018, US investors and traders may put Asia firmly on their radar. SGX’s round-the-clock platform facilitates this access up to 4:45am ET (DST) which allows participants to trade throughout the day, including US hours.

As a sign of Western appetite for Asian markets, volumes in SGX’s Asia evening session (T+1) grew 33% in Q4 2017 versus Q4 2016. In particular, the China-centric contracts SGX FTSE China A50 futures and USD/CNH FX futures doubled and tripled T+1 volumes, respectively.

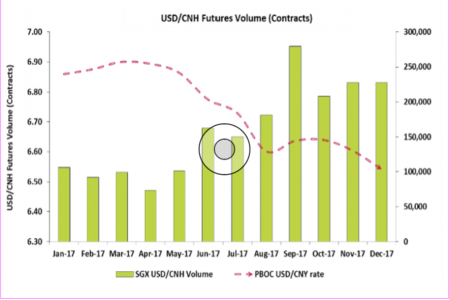

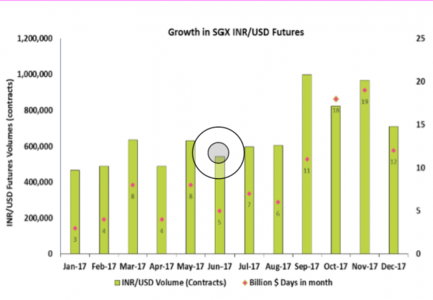

Breakout year for SGX’s FX futures

SGX’s growing FX futures franchise was up 59% in 2017 from 2016, with close to 10 million contracts traded.

Open interest also reached a new record of 118,353 contracts on December 26, 2017.

SGX rupee futures (INR/USD) and offshore RMB futures (USD/CNH) are the main drivers of this growth. These contracts ended 2017 at ADV of 37,357 (US $1.2 bn) and 11,031 (US $1.1 bn) alongside open interest of 57,857 and 25,697 contracts, respectively. New single-day trading volume highs were reached in September 2017.

Global participants have been using these futures to hedge their exposure given the periodic jumps in volatility and macro-economic factors influencing these currencies. For example, the increasing foreign direct investment into India drives the need for rupee hedging, while landmark developments relating to offshore RMB (such as the currency’s inclusion in the International Monetary Foundation’s special drawing rights basket) and partial inclusion of Chinese equities into MSCI and FTSE Russell Indices may have been a contributing factor of the heightened international investor interest in RMB.

SGX USD/CNH volumes have surpassed the 10,000 ADV mark since September 2017 and established an estimated 75% volume market share versus other offshore markets. Given the regulation and microstructure changes in favor of exchange-traded products such as Basel III, SGX is optimistic about the growth in exchange-traded FX futures.

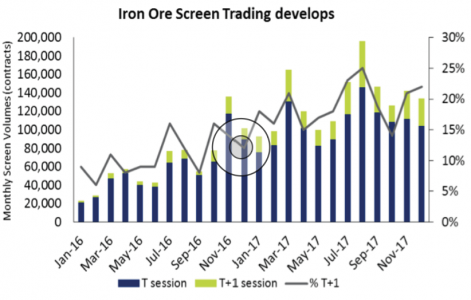

Growing financial participation in iron ore futures

SGX’s commodities derivatives shelf has been built around Asia-centric raw material trade flows and industries—iron ore, coking coal, steel, freight and rubber. As the pioneer of the iron ore derivatives market, SGX became a leading offshore market with a volume and open interest market share of 96% and 90% respectively. Leveraging on this, the SGX coal and freight contracts grew in 2017 as customers traded the “virtual steel mill” on SGX.

The growth of screen trading has been a positive development, which now accounts for 15% of total futures volume at end of 2017. SGX Iron Ore futures ADV in 2017 was 50,018 contracts of which screen traded ADV stood at 6,382 contracts, versus 4,612 contracts last year with an increasing T+1 presence.

This growth is complementary to OTC trading in expanding the size and diversity of the iron ore market. While the majority of users are Asian miners, mills and traders, there was an exciting increase in financial participation largely on SGX’s screen platform. There is an opportunity to further grow this participation and encourage the use of iron ore derivatives as an indicator of the Chinese economy’s development, given its link to industrial development and urbanisation.

Your access point to Asia

Given the liquidity of SGX’s pan-Asian multi-asset franchise, SGX’s in-depth understanding of the markets, regulatory framework and commitment to meeting the risk management needs of global investors, SGX is a choice platform for investors looking to explore the opportunities Asia offers.

This document/material is not intended for distribution to, or for use by or to be acted on by any person or entity located in any jurisdiction where such distribution, use or action would be contrary to applicable laws or regulations or would subject Singapore Exchange Limited (“SGX”) and/or its affiliates (collectively with SGX, the “SGX Group Companies”) to any registration or licensing requirement. This document/material is not an offer or solicitation to buy or sell, nor financial advice or recommendation for any investment product. This document/material has been published for general circulation only. It does not address the specific investment objectives, financial situation or particular needs of any person. Advice should be sought from a financial adviser regarding the suitability of any investment product before investing or adopting any investment strategies. Use of and/or reliance on this document/material is entirely at the reader’s own risk. Investment products are subject to significant investment risks, including the possible loss of the principal amount invested. Past performance of investment products is not indicative of their future performance. Any forecast, prediction or projection in this document/material is not necessarily indicative of the future or likely performance of the product. Examples (if any) provided are for illustrative purposes only. While each of the SGX Group Companies have taken reasonable care to ensure the accuracy and completeness of the information provided, each of the SGX Group Companies disclaims any and all guarantees, representations and warranties, expressed or implied, in relation to this document/material and shall not be responsible or liable (whether under contract, tort (including negligence) or otherwise) for any loss or damage of any kind (whether direct, indirect or consequential losses or other economic loss of any kind, including without limitation loss of profit, loss of reputation and loss of opportunity) suffered or incurred by any person due to any omission, error, inaccuracy, incompleteness, or otherwise, any reliance on such information, or arising from and/or in connection with this document/material. The information in this document/material may have been obtained via third party sources and which have not been independently verified by any SGX Group Company. No SGX Group Company endorses or shall be liable for the content of information provided by third parties (if any). The SGX Group Companies may deal in investment products in the usual course of their business, and may be on the opposite side of any trades. Each of SGX, Singapore Exchange Securities Trading Limited and Singapore Exchange Bond Trading Pte. Ltd. is an exempt financial adviser under the Financial Advisers Act (Cap. 110) of Singapore. The information in this document/material is subject to change without notice. This document/material shall not be reproduced, republished, uploaded, linked, posted, transmitted, adapted, copied, translated, modified, edited or otherwise displayed or distributed in any manner without SGX’s prior written consent. Please note that the general disclaimers and jurisdiction specific disclaimers found on SGX’s website at http://www.sgx.com/wps/portal/sgxweb/footerLinks/tos#panelhead21 are also incorporated into and applicable to this document/material.

For further details, please contact: